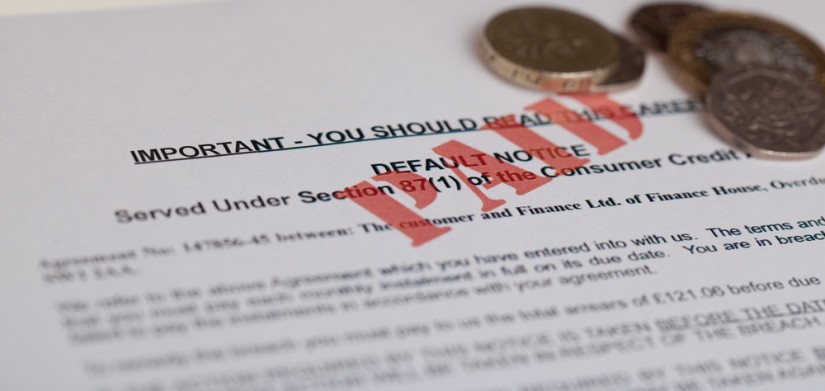

There are reasons why your personal loan may have been declined due to a bad credit profile. You may have frequently overdrawn your bank account. Your credit cards are maxed out and you have outstanding loans. And you may have a default listing on your credit history (even if it’s been paid).

Some clients often come to us saying the bigger banks declined their loan application because of a default on their credit profile even though it’s already been paid off. Paid defaults are especially problematic when you’re trying to get personal loans as it may be a bad credit potential.

Getting a personal loan with a paid default may be tricky at best and depends on a number of factors:

#1: The type of company which you have a default with matters.

If you’ve defaulted on another financial institution—especially banks—then the likelihood of your getting a personal loan may be greatly reduced. Defaulting on major banks or other financial institutions signals a lack of financial responsibility on your part and lenders may be wary of granting you credit. On the other hand, if your default is with other companies—say, an internet service provider—then your chances of obtaining a personal loan is less of a challenge.

#2: The length of time your default listing has been on your credit history.

For the record, a credit default listing—even if it’s been paid in full—will be part of your credit file for the next five years. While you’re waiting for that mark to be removed, you can have the listing marked as “paid in full” by the creditor inside of the 14 days from the time the loan was settled. Or you can get in touch with VEDA to learn how to go about it. There are lenders who consider this. If you haven’t had any defaults since then, your chances of being granted a personal loan is increased.

#3: The amount of the default and the circumstances surrounding it.

There’s more than meets the eye when it comes to loan defaults—unemployment, short-term disability, accidents, emergencies and the like may have gotten you blindsided and unable to cope financially. How extenuating the circumstance could have some bearing on the lender’s decision—not always, but it could.

Also, how much was the default for? Some lenders may take a default that’s less than $1,000 in stride, especially if coupled with any special circumstances, and allow you a personal loan or cash loan.

#4: The number of inquiries that your credit file gets.

Why would inquiries on your credit file affect your credit score and can even be a flag for bad credit in personal loans? When there are many inquiries into your credit—say, more than 15 inquiries within a one-year period—that means you may have been shopping for new credit from multiple sources. More than six inquiries or more in your credit file within a short period of time are proven bankruptcy risks. Still, inquiries have minor impacts on your ability to get a personal loan.

Paying your bills on time and a smaller debt burden are still considered vital factors to a good credit standing. So, if you have maxed out your credit cards, it may be a good idea to get that debt out of the way first so you can get to a better financial position to apply for a personal loan.

Paid default listings are explainable and may not be a factor in a personal loan. Contact us today about getting a personal loan in this and other similar circumstances.